Introduction

In the growing pace of technology, every industry wants to be a part of the race and not only they want to participate but also they want to win. Winning is any job? You all know it very well that not everyone wins the race because there is a big competition going on in the town where no one wants to lose at any cost. Today we are going to uncover the “Insurance Industry” that how they can win the race via Customer Relationship Management assistance or how CRM in Insurance Industry is very much impactful.

After watching out for the huge popularity in every sector of this software, we personally start believing that “CRM is king” of every industry because it’s quite hard to tackle any daunting task that anyone can face anytime. We believe that CRM plays a role of a “business employee” here which works on a daily basis and is ready to give their best to take the business on the next level. Not only does the software ease the problem of the industries like sales and Marketing or travel industry but also ready to rule in the Insurance industry now.

This industry from the past few years has faced several challenges and always feel like they are regularly facing competition because nowadays every business sells insurance. Instead of pondering what to do or who to not you just need to set your mind with this strategy that you have to improve your service quality first and that will be possible when you have software like CRM in your work. 65% of users said that the software is easy to use, 74% of users said that it improves the relationship with customers and if we talk about productivity then 50% of the users said that it will hike up. We are going to enlist some of the importance of CRM in Insurance industry, so understand how it is ready to handle your task.

Importance of CRM in Insurance industry?

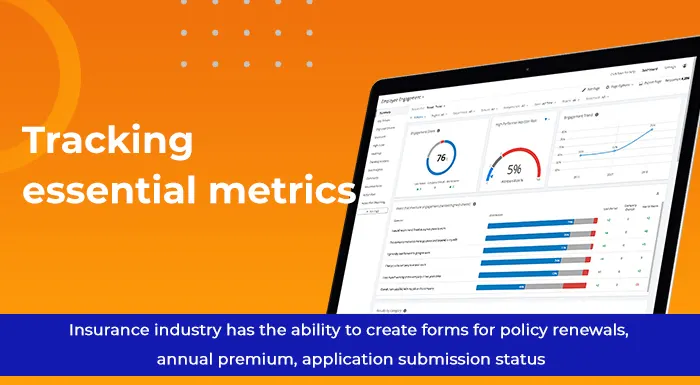

Tracking essential metrics of your Insurance industry

At present, you will not find such functionality instead of the Customer Relationship Management system as it offers the pre-built forms for your sector. The CRM in Insurance sector may be very helpful by providing the forms for revenue, campaign, leads, etc. Okay, we agree with you that forms you can create on the Excel sheet but why to waste your quality of time when the CRM is ready to complete the process promptly.

For your clients, the Insurance industry has the ability to create forms for policy renewals, annual premium, application submission status, your client’s productivity and much more. Try to work in a professional way and strive for the CRM to handle this perfectly.

How about improving customer service today?

Like we informed you earlier about the CRM Call Center that it surely improves customer service and this time again we must say that CRM in Insurance sector not only strengthen their work but also can improve customer services. Let’s delve deeper into the reason behind how it will improve as the software like CRM offers you the features called case management and ticket management.

You have a chance to accept the request of your customers’ queries from plenty of channels and not only this but also you can track them as well. So, in short, if your customer raises a question about their insurance policy, collision coverage or anything, you can now respond to them swiftly.

The software offers Professional service automation

This is one of the most effective features of this software for all the insurance professionals that are in need to get connected with exceptional functionality today. We are introducing to you a feature called Professional service automation in your insurance sector where every expert should feel thankful because this system will take care of your resource management, time recording, expense reporting, invoicing clients, billing and there were many.

You will feel like your customer receives the crucial data swiftly and can make the decision after knowing about the data. Thanks to Customer Relationship Management to minus the efforts of insurance professionals here.

The system will take care of customers data too

You already understand the Data privacy law of every industry which you can’t neglect and every business should bear in mind. So, the question is how can this software prove that it is better for data handling of the insurance industry?

The software like CRM in Insurance Industry should be GDPR Compliant where it easily helps the agents of the insurance sector to handle every data that is worth it. You can go in-depth by reading out SuiteCRM GDPR where the motive of this software is not just to store the data and feel relief but also it will open up their eyes and maintain proper security so that data remains in a safe zone all the time. Don’t feel fret when this system is ready to handle your work burden.

Assist you for hiking up your revenue in business

CRM is not just about improving the customer service as it has more such stellar functionalities like improving the workflow that you made to monitor the sales and yes, you can follow up the email that comes all the time as the software is the best one to remind you all such things that you need to do.

CRM in Insurance Industry offers you a perfect cross-sell and up-sell opportunity. Big deal! The software gets appreciated because of its tracking tactic as it will be easier for the insurance company to assign the product and service to the right customer where it will fulfill your needs.

Share your efforts a little more on potential leads

In this era, it’s very challenging to make a relationship with the prospects to turn them into your forever customer. A little bit of attention is needed and here you must take the assistance of the software called Customer Relationship Management which may help you to keep your focus and efforts more on the potential leads. For instance, the CRM can assist in managing policies related to funeral services, ensuring that customers’ specific needs are met with tailored options, whether it’s for burial, cremation, or other arrangements.

Here using the CRM in Insurance sector, what you have to do is set the criteria or eligibility like you can say age, location, policy preference, interest and much more. Suppose if you have set this criteria then do you know what role this software will play for you? It will start its goal of setting up the leads and prioritize them as applicable and in this way you get connected with those leads first who are more interested to get in touch with your Insurance business.

Parting Words

Now it’s a big relief that every Insurance professional feels because we have put a spotlight on one of the most essential software of today’s era that is near to their doors and ready to offer bundled advantages for your work enhancement. We heard that many feel hectic to tackle the customers in the insurance sector as there can be many reasons behind, so from now onwards if you adapt CRM in Insurance sector then it is ready to offer you a seamless experience as we already shared with you the best benefits of it above. Not just it makes your work quality easy but also you can expect your business to expand more, minus your efforts, save countless hours and much more. After reading out this whole article, we are sure that if anyone asks you about which software is accurate for the insurance business then you all will speak up “CRM in Insurance industry is best for business”.

Author’s BIO

With 15 years of experience in CRM, I specialize in developing plugins for SuiteCRM and SugarCRM. My notable creations include SuiteCRM Email to Lead, SuiteCRM BCC Archiver, and SugarCRM Mailchimp. My expertise lies in enhancing CRM functionalities to drive business efficiency and growth.

Additionally, I create content on YouTube, sharing insights and tutorials on CRM solutions to help businesses enhance their efficiency and growth.