If you are targeting clients in the US, you must have proper payment methods in place. The last thing you want as a company is to lose business because you didn’t provide your customers with suitable payment options. Modern consumer demographics, especially in the United States, require multiple options while making the payment and a smooth checkout experience. A recent survey by PPRO revealed that nearly 42% of US customers prefer not to purchase a product if they do not get their preferred payments. As much as 50% of the customers would avoid purchasing if the payment system and checkout process were too complicated.

Irrespective of whether you are a freelancer, e-commerce business owner, or have an established business looking to expand footprints in the US market, you must have reliable payment gateways in place. However, with so many options available, figuring out which one is right for you can be quite challenging. You can go with trial and error, but if you are equipped with knowledge about the top 10 payment options and the main features you should look out for, your decision-making can become easy.

If you are a freelancer, you should know that if you get a $100 payment from a US client, your payment gateway gains some commission for currency conversion and then transfers money into your bank account. It means that if you bill a US client for $100, you typically receive between $92 and $100 after deductions.

So, in this blog, let us learn all about the top 10 payment gateways to receive payments from US customers. We will start our discussion with the basics.

What Do We Mean by Online Payment?

The foundations of online payment involve an electronic transfer of currency via the Internet. The core process includes transferring the amount from the customer’s bank account, credit cards, debit cards, etc., and depositing it in the bank account of the seller. Sellers and buyers need online platforms to make this purchase possible. These online platforms have become more robust and secure with evolving technology. This has improved customers’ confidence in these payment methods.

Around 82% of US customers use online payment options nowadays and the total estimated value spent by United States customers in 2023 alone was $703 billion. The growing use of these payment options by US customers can be attributed to their increasing user-friendliness and advanced security measures like AI-based fraud detection protocols, improved encryption methods, and adherence to local regulations.

What Do We Mean by Online Payment Gateways?

As stated in an earlier section, sellers and customers need an online platform that can facilitate this digital transfer of money. This has given rise to modern payment gateways, which are technologies that enable sellers to receive customer payments. They are basically platforms that sort of act like a broker in digital payments. It enables users to accept, manage, and process numerous payment methods like credit cards, digital wallets, debit cards, etc., in an efficient and secure way.

In other words, they are networks through which a customer can transfer the required amount to you. They are analogous to the payment terminal we see in a conventional brick-and-mortar store setup. Basically, when a customer makes the payment through a payment gateway, it checks the payment credentials and verifies that the customer has the requisite funds in his bank account.

There are various payment gateways in the market that we will cover in this blog, like Payoneer, Paypal, Stripe, Skrill, Wise, etc. Let us first discuss what features can expect from a payment gateway.

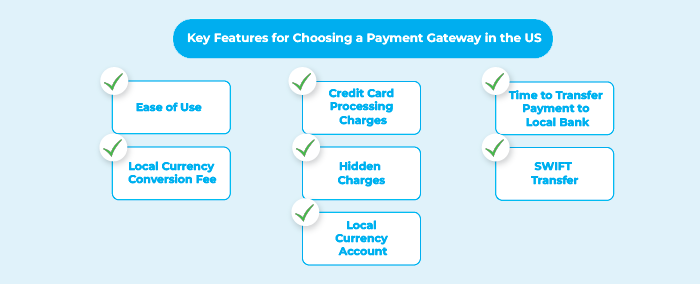

Top Features to Consider While Choosing a Payment Gateway for US Clients

Choosing the right payment gateway can be a tricky decision that can make or break your business. Knowing what feature you must look for in a payment gateway option is a good place to start. Here are the top features to consider:

- Ease of Use: Keep in mind that the business is not done until the customer has made a payment. So, the payment gateway is a core part of the customer experience that you must focus on. If the interface is intelligent, transparent, and easy to navigate, the payment process can become a lot simpler. It makes your business more reliable, decreasing confusion and friction at the last moment. Thus, for a higher conversion rate, the payment gateway must be easy to use.

- Credit Card Processing Charges: It is the credit card processing amounts that businesses have to pay to the payment gateways for a particular credit card transaction. The amount is set by credit card providers and differs from one credit card transaction to another. It also depends on the credit card processing method you are using. While choosing a payment gateway, you must take care of the fact that credit processing charges are nominal.

- Time to Transfer Payment to Local Bank: The time taken by the payment gateway to transfer money to the seller depends on multifarious factors. These might include the time of day, country, payment method, bank, interbank transfers, cut-off time, etc. The time to transfer typically varies from minutes to two to three business days.

- Local Currency Conversion Fee: It is the amount charged by payment gateways for converting foreign currency into the local currency of the seller. Typically calculated in terms of percentage of the overall transaction amount, it depends on the currency pair and payment gateway you are using. For example, a Japan-based seller can sell a product to a US-based person. The customer in the US makes the payment in US dollars; the payment gateway converts the paid US dollar amount into Japanese Yen.

- Hidden Charges: There are some additional services that sellers need, like advanced fraud detection, international transactions, currency conversion, etc. A transaction discount rate is a type of hidden charge that some payment gateways charge. Hidden charges vary depending on payment gateways, services, currency, country, payment model, etc. All payment gateways must be transparent with their users and must reveal all charges in the quotation.

- SWIFT Transfer: SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications. It is a network of banks that facilitates fund transfers between banks. All the international payments made through this SWIFT network are called SWIFT payments. SWIFT payments need an intermediary bank that facilitates the sending and receiving of international payments for a user. SWIFT is neither a banking system nor transfers actual funds. It just sends payment orders in the form of SWIFT codes between two banks.

- Local Currency Account: This is a special type of bank account provided by payment gateways. It enables businesses to receive international payments in foreign currency and hold them for some time before converting them into local currency. All payment gateway options must provide support to local currency accounts to be flexible with conversion timings, minimize conversion charges, and facilitate international payments easily.

Now, let us consider the top options you have in payment gateways.

Top 10 Payment Gateway Options for US Customers

Choosing the right payment gateways helps you ensure optimal satisfaction of overseas clients and maximize earnings. Here are the top options-

Payoneer

It has all the features you need to ensure quick, secure, and low-cost transactions. It is not only used by millions of customers worldwide but also a preferred platform in prominent marketplaces. It provides accessibility to local currency accounts and helps you control your currency conversion time and expenses. Once you bill your clients, you can get directly paid by ACH bank debit, credit card or debit card, or local bank transfer.

Integrating Payoneer helps you get business from numerous networks and marketplaces and ensures cross-border transactions, receiving the amount directly into your Payoneer bank account. Unlike conventional payment methods, there are no obligatory GST/VAT charges in Payoneer. It also offers 24/7 support, which helps you remain secure at all times. It also supports 70 currencies and offers support to millions of users worldwide.

It can be easily integrated with websites, platforms, services, and accounting software thanks to its well-designed APIs. Thus, it is a suitable option for freelancers, small businesses, and new e-commerce platforms looking to include new cross-border payment functionalities in their payment systems. It offers free transactions if both merchants and customers have a Payoneer account.

Features:

- Ease of Use: Very easy

- Credit Card Processing Fee: 2.9% + $0.30 per transaction

- Transfer Time: 3-5 business days

- Conversion Fee: 2.5% above market rate

- Hidden Charges: Yes, varies by country

- Swift Transfer: Yes

- Local Currency Account: Available in many countries

Payoneer Pricing Plans:

- Credit card: 3.20%+$0.49

- ACH Bank Debits (US Only)- 1%

- PayPal Users- 3.99%+$0.49

- Get a detailed pricing plan from its official website.

Paypal

Paypal is a widely trusted platform that has redefined the world of commerce for millions of worldwide customers. By the end of the year 2023, it had already completed 25 billion payment transactions, catered to 426 million active seller and customer accounts, and had reached a total payment estimate of 1.53 trillion. For 25 years, it has dominated the international transaction market because, for a few years, it had no competitor.

Even with the emergence of several competitors, it has continued to be a key player in the digital commerce industry. It is at the forefront of all payment gateways used in nearly 200 markets. Launched in 1998, it believes in trust, privacy, and responsible business practices. You can assess its level of transparency through its annual global impact reports.

Though it is considered to be a little costlier than other gateways, it includes no setup charges and monthly expenses. Charges are only applicable when you finish a sale and can also apply for discounts if you have a high sales volume.

Features:

- Ease of Use: Easy

- Credit Card Processing Fee: 3%

- Transfer Time: 1-2 business days

- Conversion Fee: Up to 2%

- Hidden Charges: Monthly fees apply

- Swift Transfer: Yes

- Local Currency Account: Yes

Paypal Pricing Plans

- Commercial transactions- 4.40%+ $0.30 (US clients only)

- International Micropayments- 6.00%+ $0.05

- Dispute fees- $8 (Low volume) and $16(High Volume)

- Conversion rate- 4%

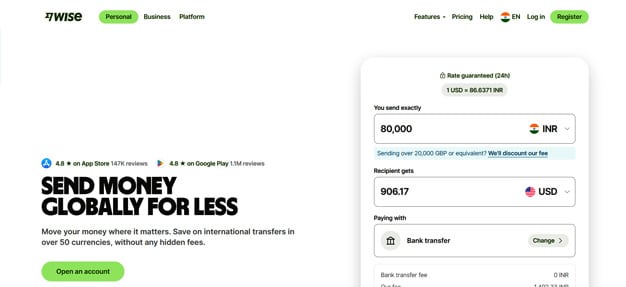

Wise

2.8 billion people. Wise is authorized to operate in multiple countries including Australia, Canada, Brazil, Australia, etc. In the United States, it is a reliable money transmitter licensed to work in 48 states. It has been found to be 3.9 times cheaper in overseas money transfers.

It keeps your money secure by ensuring 2-factor authentication, offering committed fraud detection and security teams, and holding money in only authorized financial institutions. While some institutions keep markup in the exchange rate increasing your deductions, Wise remains upfront with all the charges and exchange rate. It gives you a transparent comparison between Wise and other banks and providers for international transactions so that you can make a beneficial decision.

Features

- Ease of Use: Easy

- Credit Card Processing Fee: Not applicable

- Transfer Time: 1-3 business days

- Conversion Fee: 0.35% - 2%

- Hidden Charges: No

- Swift Transfer: Yes

- Local Currency Account: Yes

Wise Pricing Plans

- Registration Charges- No charges

- Sending Money- Starting from 1.36% (It may vary as per the currency)

- Receiving Money- $6.11* (Swift payments and USD Wire)

Skrill

It is a comprehensive payment solution where you can make payments, receive payments, or even buy cryptocurrencies. Rated highly on Trustpilot, it offers competitive rates, credible service, and fast transaction facilities. It allows you to receive money that is suitable for you with total convenience and simplicity. You can receive payments in the bank account of your choice or you can receive them on your Skrill account and then transfer it to your preferred bank account. All the transfers deposited in the Skrill account are readily available and can be accessed via the phone number or email address

Features

- Ease of Use: Moderate

- Credit Card Processing Fee: 2.9% + fixed fee

- Transfer Time: 1-5 business days

- Conversion Fee: 3.99%

- Hidden Charges: Withdrawal fees apply

- Swift Transfer: Yes

- Local Currency Account: Yes

Skrill Pricing Plans

Stripe holds no service charges, setup expenses, or monthly service charges. For detailed features and pricing information, go to the official website.

Razorpay

Razorpay is a credible solution if you want to open global revenue streams, reduce customer work during the checkout process, and save time in online transactions. It enables you to accept payments in 100 major currencies including US dollars. Furthermore, there is an in-built PayPal integration option that empowers Razorpay users to reach out to a wider customer base. Users who integrate Razorpay with PayPal enjoy a 20% higher success rate and quicker settlement time at no additional charges. The transaction charges will be defined by the rates set by PayPal.

More features include automatic settlements in local currency, smooth and convenient activation, and currency conversions in real-time. It also gives you the accessibility to a wide range of payment methods like net banking, credit cards, debit cards, digital wallets, etc. Trusted by top brands, it augments your global business experience bringing effectiveness, efficiency, and user-friendliness to your payment systems.

Features

- Ease of Use: Developer-friendly

- Credit Card Processing Fee: 2% + ₹3 (domestic cards) / 3% + ₹3 (international cards)

- Transfer Time: 2-3 business days

- Conversion Fee: 1.5-2%

- Hidden Charges: No

- Swift Transfer: Yes

- Local Currency Account: Available for Indian businesses

Razorpay Pricing Plans

- Annual Maintenance Fee- $0

- Setup Fee- $0

- Platform fees- 2% (applicable on all transactions)

- You can request customized pricing for other suites of services. For more details, visit the Razorpay website.

Apple Pay

Apple Pay comes in-built on many devices like iPad, Apple Watch, iPhone, Apple Vision Pro, and Mac. It offers easy, reliable, and secure payment processing guaranteed by Apple’s trademark reliability. Not only is it accepted in multiple European, Asia Pacific, African, and Latin regions, but it can also be easily integrated into your apps and websites. It supports all the known payment methods like credit cards, debit cards, digital wallets, etc. Also, it takes mere seconds to set up Apple Pay on your Apple device with a detailed process given on the Apple website.

Because of Apple’s consistent emphasis on privacy, product quality, and smooth user experience, it is a trusted brand among US citizens. So, if you use Apple Pay as your payment gateway, you have a higher chance of maintaining your brand reliability. Irrespective of whether you use Apple Pay in your store, website, or applications, it does not charge any fees.

Features

- Ease of Use: Very easy

- Credit Card Processing Fee: Varies

- Transfer Time: Instant to 3 days

- Conversion Fee: Bank-dependent

- Hidden Charges: No

- Swift Transfer: Yes

- Local Currency Account: No

Apple Pay Pricing Plans

Though Apple does not charge any additional fees, your linked bank account can charge foreign transaction fees. This generally varies between 1 to 3% depending on your country and currency. For more details, visit the official Apple website.

Western Union

Trusted by a broad range of users all around the world, it offers a dependable way to transfer money globally. With a mission to improve the world economy, it streamlines cross-border payments and connects users to worldwide bank accounts. Apart from offering ease of use, it also keeps all the transfers secure through efficient data security and data encryption mechanisms.

It enables US customers to send money to countries like Canada, India, Columbia, Mexico, etc. It is an all-in-one payment solution that enables users to send money, receive money, and monitor a money transfer. While receiving money, it enables users to receive money either in bank accounts, by cash agents, credit cards, debit cards, or through mobile wallet deposits. Country-wise details regarding direct bank transfers are provided on the Western Union official website.

Features

- Ease of Use: Easy

- Credit Card Processing Fee: High

- Transfer Time: 1-2 business days

- Conversion Fee: High

- Hidden Charges: Yes

- Swift Transfer: Yes

- Local Currency Account: No

Western Union Pricing

It charges a nominal transfer fee which varies as per the principal amount. For example, if you want to send money from the US to Egypt, the transfer fees vary between $1-100 for the principal amount between $1-7,5000.

Remitly

A range of options in payment delivery methods, on-time delivery, and secure money transfer are some of the reasons that have contributed toward Remitly’s credibility as a dependable payment gateway. With multi-layer security, you can reliably send money globally to 170+ countries in 100+ currencies. It not only offers you great value with lucrative rates, special offers, and no hidden charges but also provides you peace of mind during transfers.

Apart from ensuring robust security mechanisms, it also promises 24/7 support in case of any problems. It gives you a guarantee in terms of delivery time with a promise of a fee refund if it fails to deliver. It leverages its global network of banks and cash pickup locations to cater to millions of worldwide customers.

Features

- Ease of Use: Easy

- Credit Card Processing Fee: Varies

- Transfer Time: Instant to 3 days

- Conversion Fee: 1%-2%

- Hidden Charges: No

- Swift Transfer: Yes

- Local Currency Account: Yes

Remitly Pricing

It follows total transparency in terms of pricing and charges. Merchants can see the exact amount they receive after all the deductions. Transfer fees depend on country, delivery method, principal amount, and currency.

Let us take the example that the merchant is in Mexico and the customer is in the US. Then, the charges are as follows-

- A Debit card or bank deposit fee- $1.99

- Cash pickup fees- $3.99

- Mobile transfer fees- $1.99

Wire Transfer (SWIFT)

Though the wire transfer is not technically a payment gateway or a tool, it is an efficient way to receive money on an application or website. It is a type of EFT (Electronic Funds Transfer) that enables users to transfer and receive payments from one bank account to another. Wire transfers are popular among US customers for both domestic as well as international transfers. Mainly, wire transfers are associated with overseas money transfers and can be used to receive payments from US customers.

Wire transfers enable users to transfer wire payments in a secure, quick, and efficient way without requiring any cash. These payments are generally processed from one financial institution to another even if they are in different geographical locations. Here, the sender must include the recipient’s account number, bank number, branch code, SWIFT code, the reason for the transfer, etc.

Features

Ease of Use: Moderate

Credit Card Processing Fee: Not applicable

Transfer Time: 2-5 business days

Conversion Fee: Varies

Hidden Charges: Yes

Swift Transfer: Yes

Local Currency Account: Yes

Wire Transfer Pricing

All the exchange rates, fees, and charges are decided by the banks through which you are sending the money.

Modern Payment Gateway Trends: How AI Is Helping?

- Artificial Intelligence has completely transformed the way we proceed with international payments. It has turned out to be a vital technology that has improved the security, speed, efficiency, and convenience of money transfers across countries. Let us see how AI is revolutionizing the complex landscape of international money transfers:

- More Sophisticated Fraud Detection: All the modern banks and reliable payment gateways integrate advanced fraud detection measures that utilize AI technology to minimize the risk of fraud and spear phishing, and improve customer security.

- Intelligent Conversion of Currency: AI-based tool has improved the accuracy and preciseness of exchange rates, reducing losses in currency conversion. AI can help in forecasting fluctuations in currency, recognizing conversion times, and understanding risks in foreign exchanges much more accurately. AI equips customers with enough details to be alert while transferring money to volatile markets.

- Automation in Invoicing: Advanced AI tools can efficiently create precise invoices, monitor all payments, and even send automated reminders to customers.

- Making Payment Gateways More Customer-Friendly: One of the intentions of creating payment gateways is to ensure a streamlined checkout experience for the customers. AI-based analytics and predictive analytics can detect user trends and evolving requirements. This can provide businesses with more insights to further optimize their payment systems and enhance their customer experience.

Conclusion

There are a plethora of smart payment gateway options that have their own benefits. However, each option comes with its own charges that can incur deductions and impact your earnings. Choosing the right payment gateway is vital for your business expansion in countries like the US as it ensures optimal customer experience and maximizes profitability. The blog explores all payment gateway options in a nutshell: exploring all the fundamentals, features, and top gateway options you must know.

The blog is relevant for you if you are a freelancer, entrepreneur, or global enterprise looking to gain traction in the US market.