The ever-evolving market disruptions are reshaping the landscape of private equity (PE). In response, leading firms are increasingly adopting an outside-in due diligence (OIDD) methodology to unearth opportunities, mitigate risks, and maximize returns—all while minimizing initial investments.

According to the AlixPartners 8th Annual PE Leadership Survey, nearly half of industry executives now anticipate fewer deals, lengthier transaction times, and more challenging exit strategies.

The Purpose of OIDD

OIDD offers swift insights to assist PE firms in mitigating risk and optimizing success prospects for potential acquisitions and empowering investors with the intelligence needed to navigate the best course of action. The fundamental concept revolves around investing minimal resources as a preliminary exploration before fully committing time and capital to a potentially unviable deal.

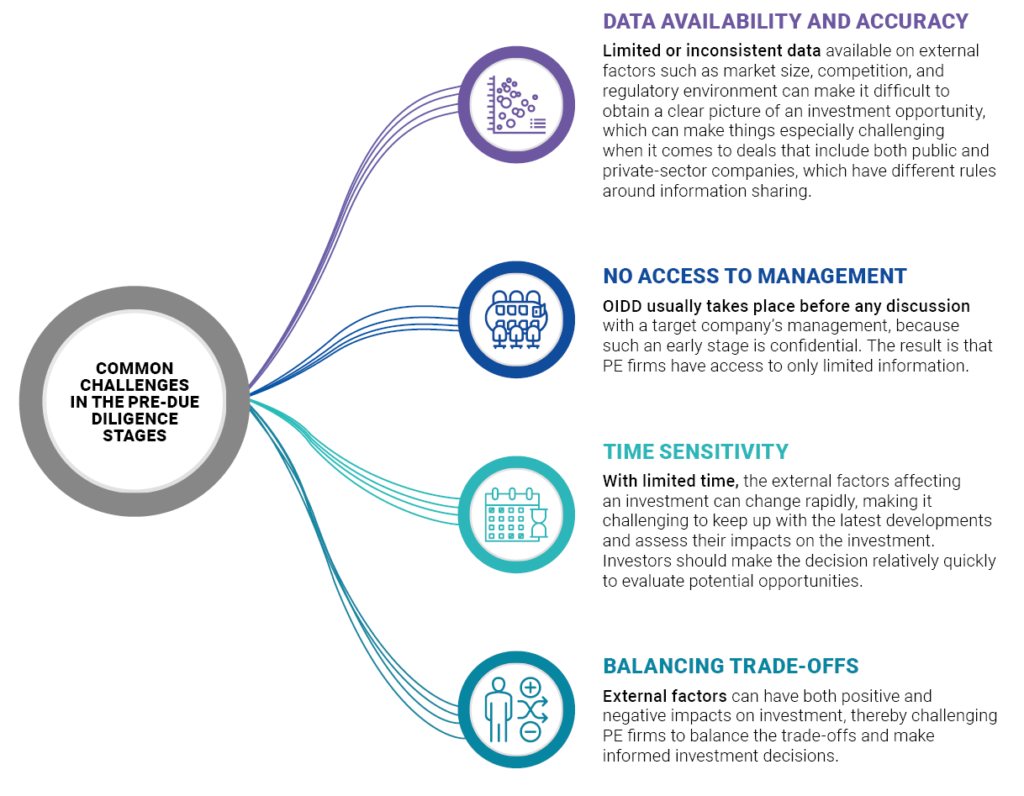

A well-executed OIDD can enable firms to address four prevalent obstacles encountered during the initial stages of due diligence:

Masterful Execution in OIDD by Leading PE Firms

Successful PE firms exhibit five distinctive attributes in their approach to OIDD:

- Holistic Business Evaluation: Astute PE firms assess the business in its entirety—encompassing both top-line and bottom-line structures—when evaluating an investment prospect. This comprehensive review includes current financial health, organizational framework, employee sentiment, and corporate culture. Such an all-encompassing approach facilitates well-informed decision-making.

- Operational Consideration: Every investment entails operational consequences. For instance, the fusion of two enterprises necessitates the integration of technological systems and software. Depending on the existing infrastructure, this process might be straightforward or could demand a considerable amount of time.

- Opportunity Realization: It is insufficient to merely identify opportunities; PE firms must pose probing questions to ascertain how these opportunities can be actualized through both short-term and long-term investment strategies.

- Actionable Insight Utilization: Possessing a wealth of operational and opportunity-related data is crucial, yet such knowledge is only advantageous if a firm can transform it into actionable insights and subsequently employ the information to inform decision-making.

Implementation of AI-Driven Analytics: The incorporation of AI-driven analytics facilitates the streamlining and automation of the aforementioned processes, thus enabling PE firms to make more judicious decisions with increased speed.

The AI-Infused Paradigm

By embracing an AI-fueled digital methodology, enterprises can aggregate and stratify an expansive spectrum of publicly accessible intelligence to architect and implement bespoke OIDD paradigms.

This OIDD paradigm empowers entities to glean intelligence from pivotal rivals, fostering benchmarking assessments, probing prospective mergers or acquisitions, and unearthing avenues for expansion. The fusion of an AI-driven, automated methodology with a seasoned cadre enables organizations to derive both expansive and profound insights, expediting the decision-making trajectory from protracted months to mere weeks.

AI-Driven Synergized External-Inside Due Diligence

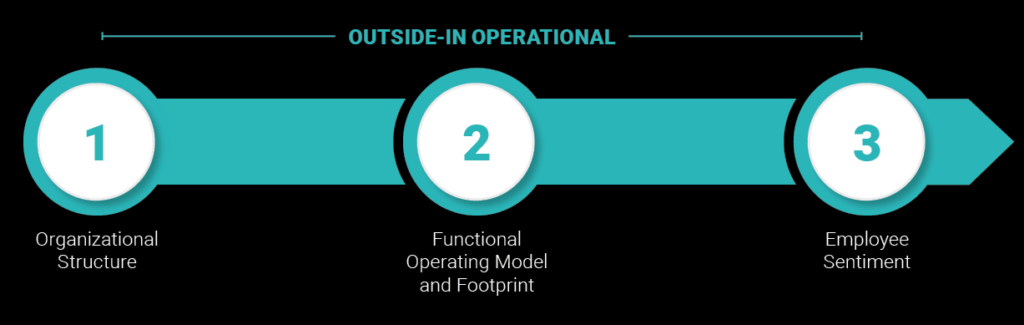

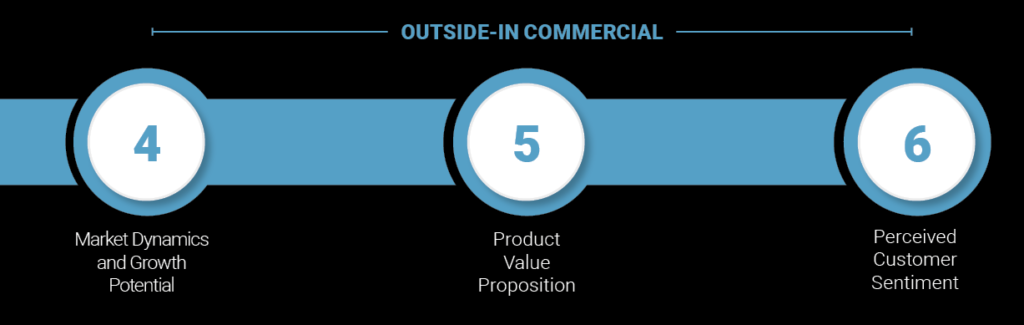

Six pivotal dimensions that AI-enhanced due diligence must encompass:

- Organizational Architecture: Through the meticulous collection and curation of publicly accessible data, PE firms can swiftly obtain an x-ray-like perspective of an entity's organizational architecture, providing a robust foundation for further scrutiny. This analysis delves into organizational tiers and spans, evaluating efficiency levels, pinpointing consolidation opportunities, benchmarking performance against industry standards, and juxtaposing the cost structures of the target entity with those of its competitors.

- Operational Framework and Geographic Footprint: Strategic relocations of personnel or facility placements are pivotal enhancements for ensuring that operations are optimally situated. By harvesting data from target sites and meticulously mapping each individual to the nearest facility, based on geographic proximity, firms can uncover and quantify opportunities for footprint consolidation. This intelligence is invaluable for assessing how strategically positioned a company is relative to its competitors.

- Workforce Sentiment: Through the deployment of natural language processing (NLP), PE firms can distill employee sentiment across critical domains such as organizational ethos, leadership dynamics, and overall engagement levels. This insight becomes particularly crucial during merger evaluations, where workforce synergy is integral to the investment thesis. Consequently, comprehending corporate culture and employee sentiment may eclipse even financial data in importance, providing a lens into current or potential efficiencies, synergies, and a benchmark for industry best practices.

- Market Dynamics and Expansion Trajectory: Employing a synthesis of analyst insights, primary research, and expert corroboration, comprehensive industry analysis can elucidate market dimensions, growth trajectories, and prevailing trends. Furthermore, juxtaposing management’s revenue forecasts against external data facilitates an assessment of realism, while also uncovering external catalysts, risks, and opportunities.

- Product Value Proposition: How do consumers discern the value of the products offered? Addressing this inquiry helps to formulate a growth hypothesis for the product portfolio and marketing stratagems. Leveraging AI-driven algorithms to harvest data on pricing, unique selling propositions (USPs), and product portfolios, and juxtaposing these with customer feedback, enables the precise identification of consumer perceptions.

- Perceived Customer Disposition: By employing structured interview frameworks and collecting a plethora of customer feedback, AI-enabled due diligence can produce an account-level analysis encompassing revenue, profitability trends, and inputs to go-to-market models, including branding and sales priorities segmented by market. Additionally, PE firms can appraise the potential for recurring revenue performance and probe common performance gaps to identify opportunities for enhancing wallet share through competitive displacement and cross-selling strategies.

Delivering OIDD through AI

Adopting an external-in perspective augments the initial stages of decision-making by equipping investors with the tools for rapid and informed decisions. However, the escalating complexity of PE transactions, compounded by the voluminous data inherent in M&A activities, underscores the necessity for AI-driven OIDD capable of swiftly aggregating, curating, and correlating pertinent data. The result? Expedited, high-value, and low-risk decision-making.

The Role of AI in Ensuring Due Diligence Integrity: The Power of AI Detection Tools

In the era of AI-driven due diligence, ensuring the authenticity and reliability of the data being analyzed is paramount. This is where AI detector free tools come into play, enabling the analysis of content and data without the constraints or false positives associated with traditional AI detection methods. Such tools are especially useful for firms looking to streamline their due diligence processes while ensuring data integrity. By leveraging AI detector-free solutions, PE firms can confidently rely on the data insights they derive, knowing that the information is accurate and untainted by any form of digital deception. This layer of scrutiny is essential, especially in high-stakes M&A activities where decisions are made based on the veracity of the data collected. Implementing AI detector-free tools as a standard part of OIDD enhances the overall robustness of the due diligence process, providing an additional safeguard against the risks posed by AI-generated. To enhance data verification in due diligence, firms can utilize an AI source code detector. It helps ensure that AI-generated content remains authentic, secure, and reliable for strategic decision-making.

Seize the Opportunity

Discover how leading firms are leveraging OIDD methodologies, enhanced with AI detection tools, to pinpoint opportunities, mitigate risks, and amplify returns. The integration of AI in due diligence not only accelerates the process but also ensures that the decisions made are grounded in verified and reliable data, thus minimizing risks and maximizing the potential for successful outcomes.

Related Posts

Machine Learning Integration: Harnessing the Power of AI in Database Services